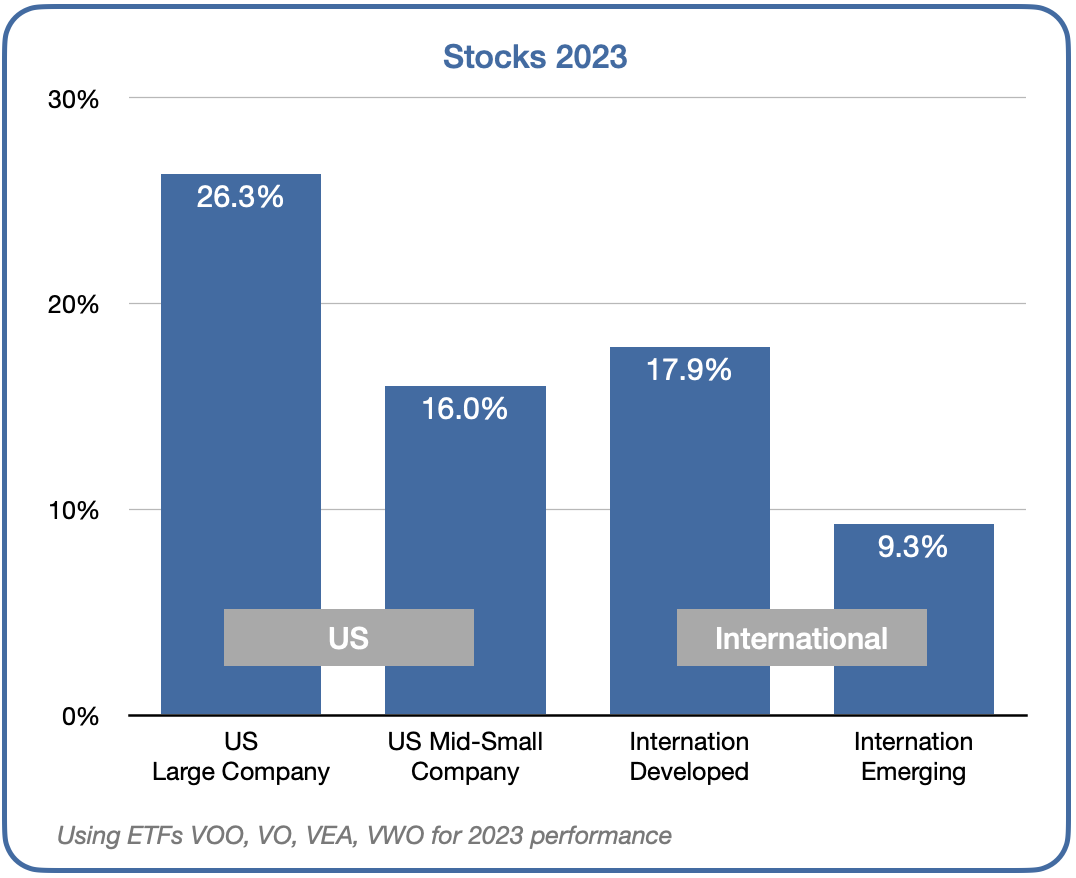

All categories of stocks were up substantially in 2023 (chart). US large company stocks ended the year up 26.3%, near a record high.

As usual, the path to good year-end returns was not straight. In 2023 it was two steps forward, one step (or two) back. As recently as late October, US mid- and small-company stocks were at a loss for the year. But the “Santa Claus rally” effect came true this year, and all categories of stocks were up sharply in November and December.

In 2023, the largest companies’ stocks did extremely well, while the rest of the S&P 500 index (US large company stocks) was good, but not great. It’s a clear difference that might be a concern for those very large stocks in 2024, which may be somewhat overvalued, leading to muted performance next year.

While investors were heartened by recent Federal Reserve statements about lowering interest rates in 2024 (which is good for stocks and bonds), and consumer spending has been pretty good, consumer sentiment is still anemic. There’s a disconnect between sentiment and spending. The US economy is largely driven by consumer spending, so mediocre sentiment might be a headwind for company profits in 2024, and stock returns.

For now, it’s good to enjoy nice stock returns for 2023.