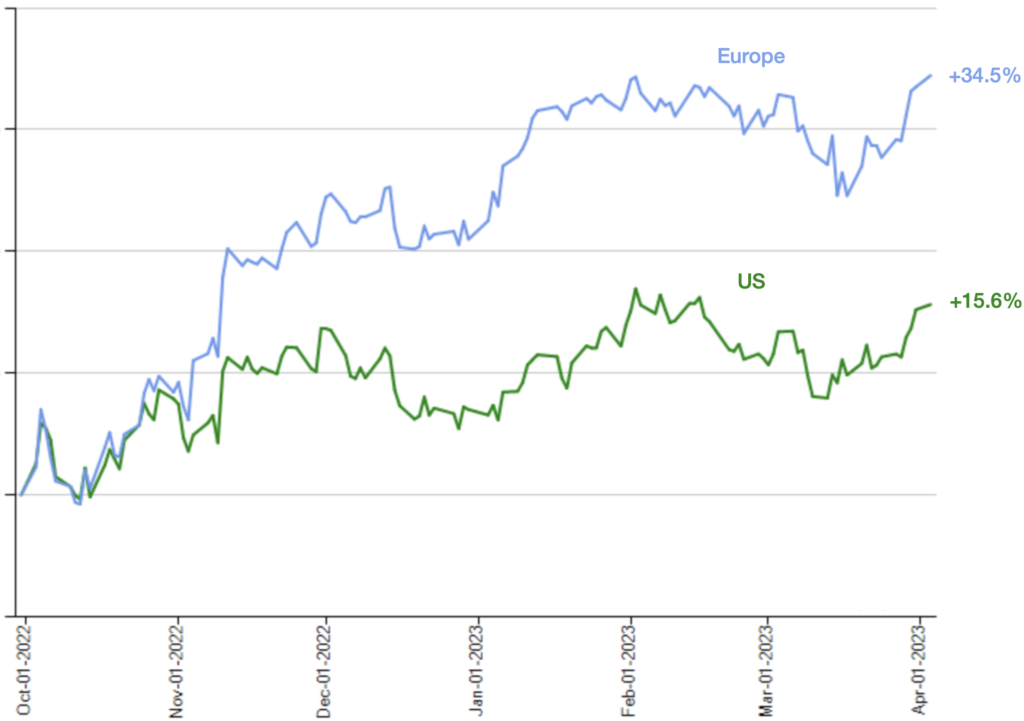

In the past six months, stocks of European companies, which were hit hard at the start of the war, gained about twice as much as US stocks: 34.5% vs 15.6%, as of April 1, 2023. This is an expression of investor confidence in Europe’s ability to find alternate sources of energy, and Ukraine’s ability to defend itself admirably.

Europe had a mild winter while aggressively securing other sources of energy, and other agricultural countries boosted their exports.

It does appear that the war will continue for a long time. (Russia first invaded Crimea in 2014.) So it’s possible that further disruption lies ahead, in addition to the humanitarian suffering. But we now see that the worst-case economic outcomes we feared at the start of the war did not happen; indeed, perhaps we see outcomes better than anyone expected.

This information is of a general educational nature, not individual investment advice. Investing involves risk of loss. A diversified portfolio does not protect against a loss or guarantee a gain.