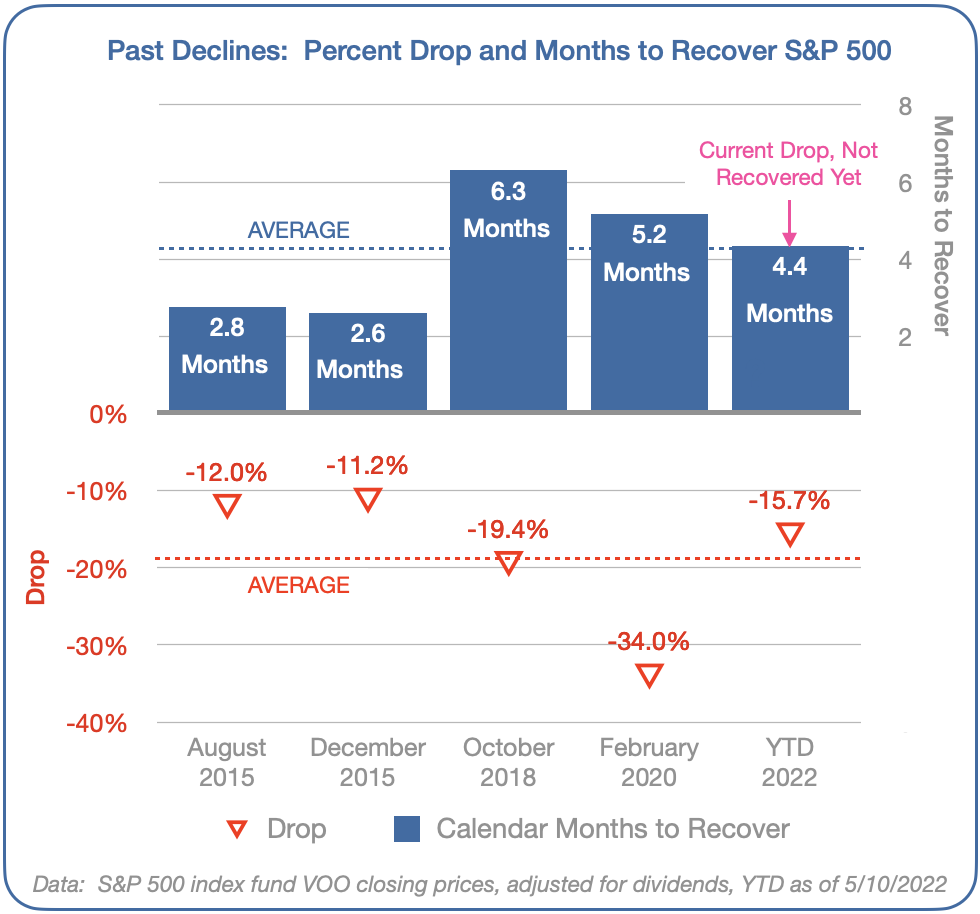

Wall Street has a quaint name for a decline of 10% or more: “correction.” Most investors don’t see it that way. But it’s a useful metric to look back at the last 4 corrections over the past seven years and compare to this year’s.

We are now 4.5 months into the Correction of 2022. The current loss of the S&P 500 is -15.7% (as of May 13 end of day, using Vanguard VOO as a proxy for the S&P 500). This is actually the average length of the past 4, but our current loss is a bit less than the average of -19.2%.

Before this year, the last correction was especially memorable: at the start of the pandemic there was a decline of 34% in the S&P 500. It recovered in 5.2 months.

Although it can be difficult to ride through these declines, it’s impossible to time the ups and downs of the market. History shows us that these declines often set up the next up-market.

This information is of a general educational nature and not investment advice. Past performance is no guarantee of future returns. Investing involves the risk of loss. A diversified portfolio does not guarantee a gain or protect against a loss. Information in this post is believed to be accurate but may contain inadvertent errors.