Indexers vs Stock-Pickers

Two competing styles of investment management are “indexing” and “stock-picking.” Which is better?

Indexing is boring: a mutual fund’s goal is to deliver exactly the return of the index — a fixed basket of stocks that doesn’t change very often. There is no attempt to beat the market. The goal is to deliver the market returns, for that particular index. Examples are: S&P 500 (US large company stocks), Russell 2000 (US small-company stocks).

Stock-pickers, also called active management, try to beat the market by making decisions about which stocks to buy and sell. Stock-pickers use lots of data and analysis to try to gain an edge. They charge higher fees with the goal of being better. Are they?

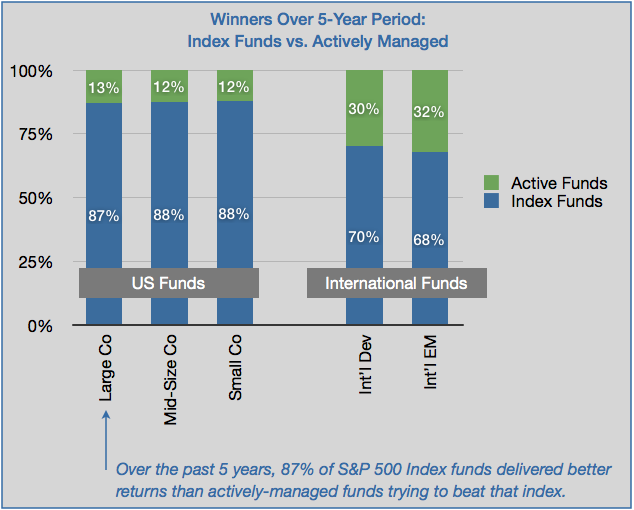

Every year the Standard and Poors company issues a report to answer the question. The chart below graphs their data for US and international stock funds over the past five years.

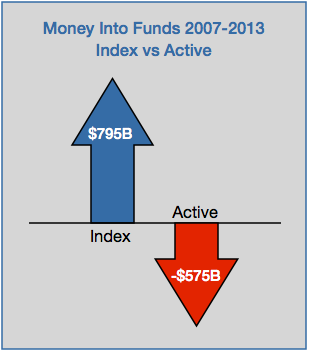

Many investors and their advisors have noticed the difference in returns. The chart below shows data from the Investment Company Institute, showing how much money went to index vs active funds from 2007-2013. Investors put $795B into index equity (stock) funds, and took out $575B from actively-managed stock funds.

Index funds do not guarantee a particular return, or even a gain. But historically, in up-markets and down-markets, stock index funds have generally outperformed their competing style, the actively managed fund.

Past performance is no guarantee of future returns. Investing involves risk of loss.