How Much Income Will I Need in Retirement?

Yogi Berra reportedly said, “It’s tough to make predictions, especially about the future.”

So how can we predict the income we’ll need in retirement?

(At the end of this article, there is very simple advice on this question.)

A study just released by the Employee Benefits Research Institute (EBRI) answers that question — about the past.

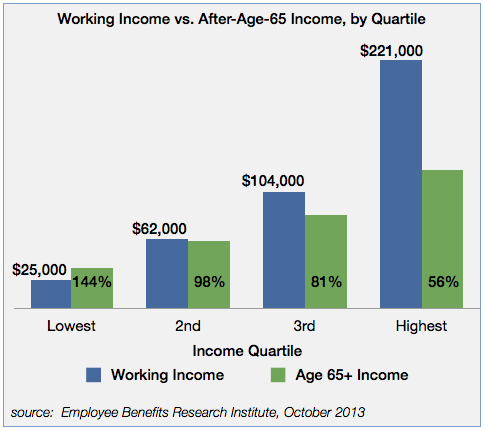

They looked at Americans who are now 65 to 69 years old and compared their actual income to 10 years ago (using inflation-adjusted dollars). Income consisted of: Social Security, savings and investments, pensions, and work earnings.

This can be a helpful reality check, and there may be surprises.

The financial press and financial planners often talk about replacement ratio: the percentage of working income needed in retirement. The simplistic rule of thumb is 80% of pre-retirement income, but often that isn’t realistic.

The EBRI study found that average replacement ratio varied widely by income quartile. (Highest income in the top quartile, lowest income in the bottom quartile, incomes over $1M excluded.)

You might be surprised that:

- highest quartile Americans had a steep drop-off in income: from $221,000 (average) to $123,000; about 56% of pre-retirement income. Many kept working past age 65; about 30% of highest-quartile income was from work. Would their income drop further after that work stopped, making the overall percentage even less? Will Social Security become a higher percentage?

- lowest quartile Americans ($25,000 working income, average) had more in retirement, though it varied widely within the quartile. This is because over half their retirement income is from Social Security, earned over a lifetime of work. The formula is deliberately biased to provide a higher percentage of income to lower income workers. But note the caveats below about heavily depending on Social Security, regardless of quartile.

- all quartiles had significant work income in “retirement” — 20% to 30% of income was from work. That breaks the old stereotype. For many, retirement is an opportunity to take a job that might be less stressful or more rewarding, but pays less; it could also be a necessity.

So the general rule of thumb (80% replacement) has been true only for households with about $100K income on average.

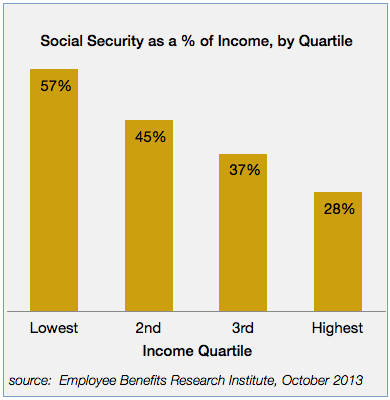

All quartiles depend on Social Security income… from 57% (lowest quartile) to 28% (highest quartile).

That represents a risk for two reasons:

- Social Security will run short of funds in 20 years (2033) and be able to pay 77% of total retirement benefits at that time if no changes are made. (Social Security Trustees Report 2013)

- For a household receiving two Social Security checks in retirement, the lowest check will stop with the loss of the first spouse: the surviving spouse may have to live on less.

For most people, depending on Social Security is a necessity, but we have to be aware of the risks and plan for them.

The EBRI study also highlighted two expenses in retirement that are often overlooked: health care costs and long term care.

Simple advice : Determine what you are spending now.

We offer Retirement Planning that provides a comprehensive answer to the question of retirement income.