Market Results: Q3 2013

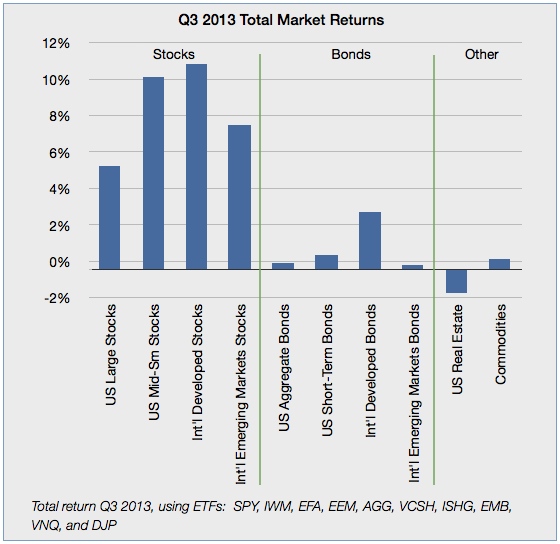

In 2011 and 2012, the third quarter was a rocky ride because of discrete events, but this year Q3 was generally good.

Most asset classes did well, with bonds showing modest gains after their losses last quarter.

Stocks generally had very strong gains. Note that emerging markets stocks suffered sharp losses in the 2nd quarter but did well in Q3.

Bonds gained in Q3 after losses in Q2. Note that short-term bonds gained more than intermediate bonds because investors still anticipate interest rate increases. Intermediate-term bonds are still negative for the year.

US real estate investments were the lone loser in the quarter, down just over 1%.

Since the start of the year, some asset classes are still showing losses while US stocks and international developed country stocks have done well. US intermediate-term bonds are down but short-term bonds have a slight gain. Emerging markets stocks and bonds are down.

The year-to-date returns show the value of diversification, where some asset classes have done very well while others have lost.

Disclosure: This information is educational in nature and not specific investment advice. Investing involves risk of loss. Past performance is no guarantee of future returns. A diversified portfolio does not protect against a loss or guarantee a gain.