Market Results: Q2 2013

Three headlines last week:

“Consumer Sentiment Near 6-Year High”

“Home Prices Show Biggest Gain in 7 Years”

“Worst Quarter for Bonds in Nearly 20 Years.”

Wall St. meet Main Street.

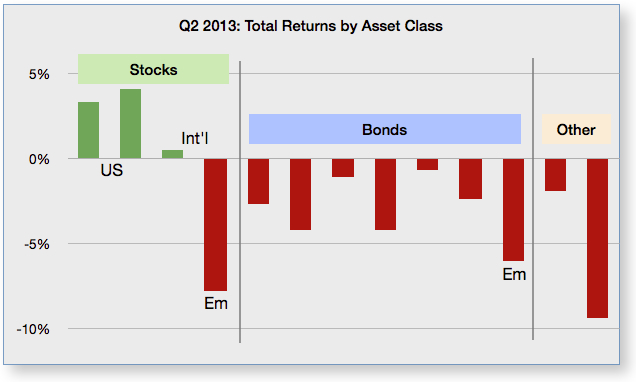

With the exception of US and international developed country stocks, all other capital markets were down in Q2:

Why?

Although Americans felt better about their financial prospects and saw their homes appreciate in value, some investors (over-) reacted to comments from Federal Reserve Chairman Ben Bernanke about the eventual tapering of the Fed’s programs to stimulate the economy. Bonds went down. Those comments shouldn’t have been a surprise, and even the Fed was puzzled by the market reaction; they quickly sent out various members to walk back the time table and reassure bond markets. Bonds did recover some of their lost value after a few days.

Some bad news came from China which saw a brief but sharp liquidity crisis as the short-term inter-bank lending rate shot way up. Some analysts saw the new president asserting his authority and sending the message that banks must lend more responsibly. That’s actually welcome news, unless you’re a Chinese bank with lots of risky loans.

Not surprisingly, emerging markets stocks and bonds were hard-hit (marked “Em” on the chart). Commodities also tumbled (under “Other” on chart) because they are sensitive to interest rates and emerging countries’ economies are tied to raw materials (some commodities) more than developed markets.

Meanwhile the US economy continues to make steady but slow progress, which investors recognized, resulting in gains for both large, mid- and small-company stocks. That was the only bright spot this quarter. As quarterly results come in over the next month, we’ll see if that optimism was warranted.

Longer TermWhile painful in the short run, those two events might actually help in the longer term because they serve to reduce the chances that a bubble will develop when speculators see markets as only going up. Speculative bubbles never end well.

Lower bond prices also eventually provide better rates to income-oriented investors, and move rates more in-line with historical levels. Interest rates had been at historic lows.

So while returns for the quarter were mostly negative, the reasons don’t necessarily indicate poor underlying fundamentals, and might actually lay the foundation for better returns longer term.

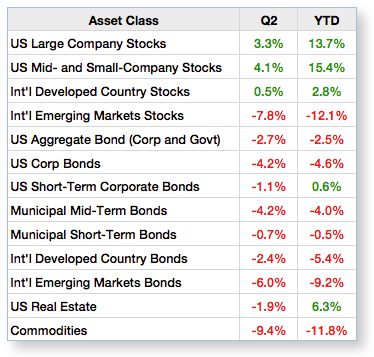

Asset Class Results for the Quarter and YTD

Disclosure: Investing involves risk of loss. Past performance is no guarantee of future returns. A diversified portfolio does not protect against a loss or guarantee a gain.