A Tale of Two Economies

Some recent economic news is showing an increasing split in various fundamentals.

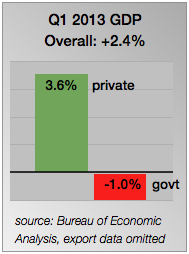

US vs. EuropeThe US economy is gaining steam while the European economy is slowing down. Unemployment is down in the US, up in Europe. GDP growth is up in the US, down in Europe, with some countries in recession. US GDP grew 2.4% in Q1 but Eurozone GDP was down 0.2%.

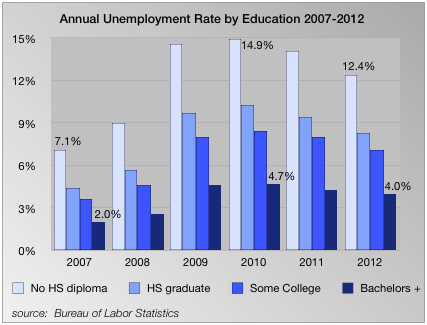

US Employment: Highly Educated vs. Less Educated

Throughout the recession the unemployment rate for highly educated workers was much lower than the less educated. This trend continues, even as the US has emerged from the recession. A related measure is consumer sentiment: higher-income workers were more optimistic than lower-income workers. Overall, sentiment is the highest since 2007.

US Public Sector vs Private Sector In the first quarter of 2013, the private sector grew nicely, up 3.6% while the public sector (government) subtracted 1.0% from GDP. US Stocks vs. Bonds

US Stocks vs. Bonds

Year-to-date through May 30, stocks of US large companies gained 17.1% while bonds were down 0.8%. Yields on US treasuries are climbing (which drives prices of those bonds down). For the past 9 years (from 2003 through 2012) the Barclay’s Aggregate Bond index has never had a down year.

OverallThe US economy is doing well now, but still faces challenges ahead, partly because of these illustrated dicotomies: continued federal budget reductions (the “sequester”) will slow GDP growth, the looming debt ceiling debate can cause market turbulence, and there’s the possibility that global economic troubles will eventually be felt here in the US.