Last fall, storm clouds appeared on the horizon of the global economy. Economists predicted recession, stocks and bonds were down a lot from January 2022, high inflation and high mortgage rates darkened the mood of consumers. We were heading into a winter of discontent.

Now?

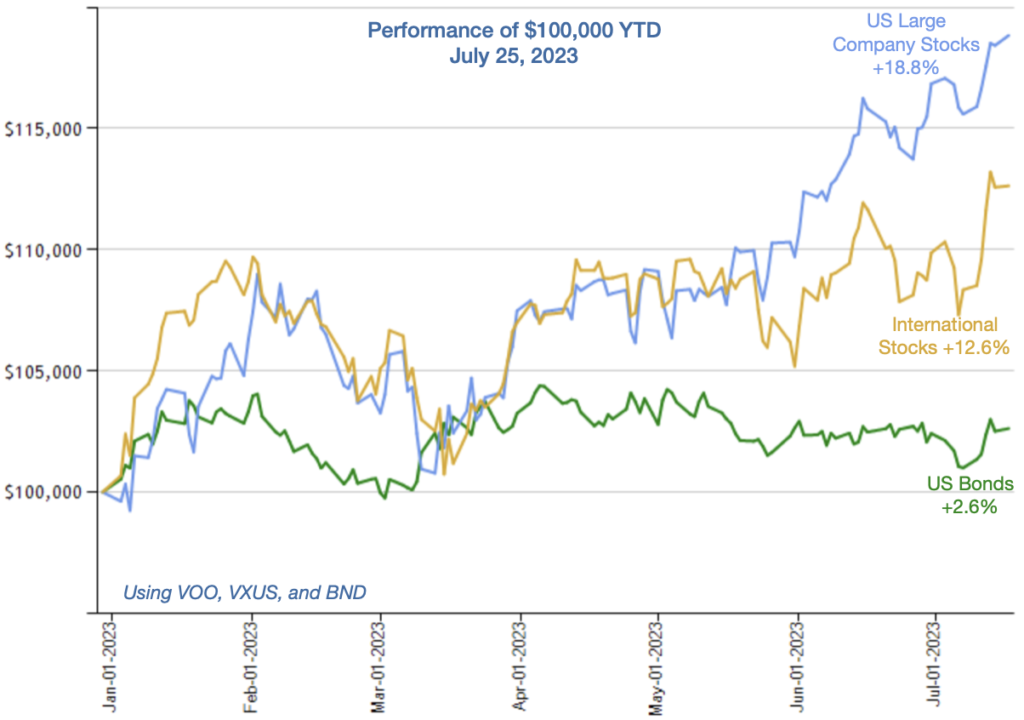

So far this year (through July 25) US stocks are up 19%, International stocks up 13% and bonds are up slightly, actually paying decent interest rates for investors. Inflation is trending down, unemployment is very low, and consumer bank account balances are up vs pre-pandemic levels.

Content?

It hasn’t been all clear skies though. Capital markets were volatile in the spring, and the breadth of gains in US stocks has been concentrated in large fast-growth companies. Will the gains expand to more companies? Will the Fed keep raising short-term rates to intentionally depress the economy and meet their 2% inflation target?

As usual, there are uncertainties in the outlook for capital markets. But let’s take a deep breath and enjoy the sunny weather we have now.

This information is of a general educational nature, not individual investment advice. Investing involves risk of loss. A diversified portfolio does not protect against a loss or guarantee a gain.