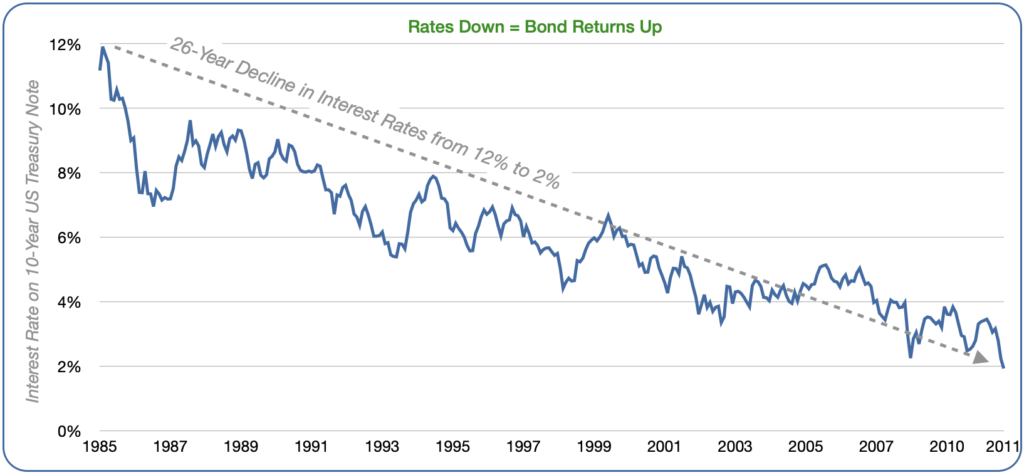

Bond Rates Go Down For 26 Years from 1985 to 2011

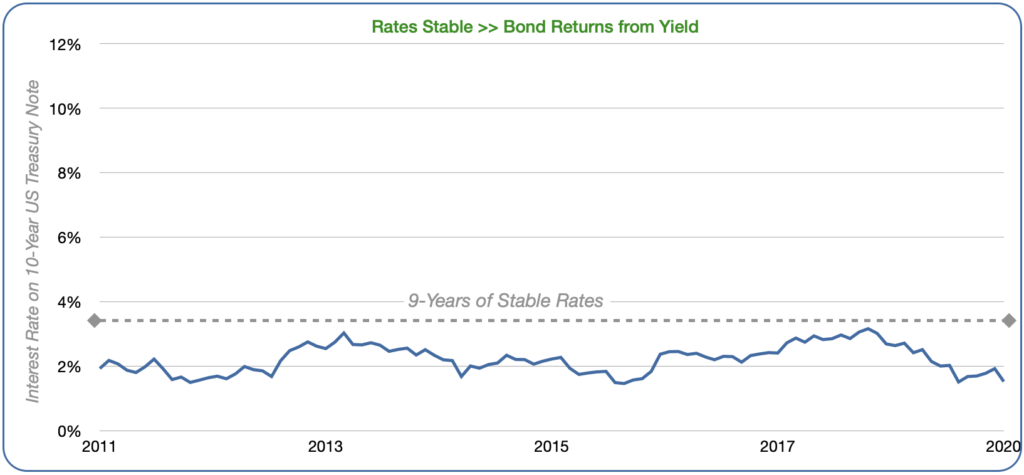

Bond Rates Stable for 9 Years from 2011 to 2020

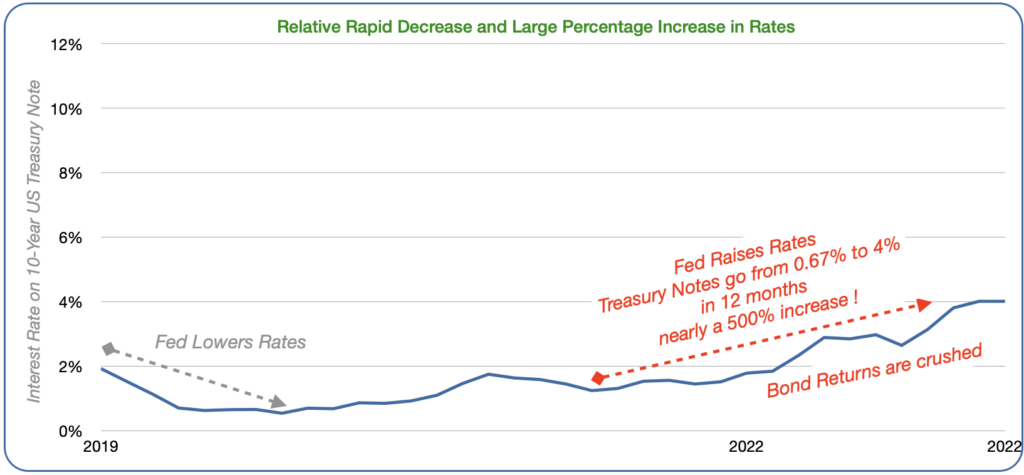

Pandemic: Rates Down then Up

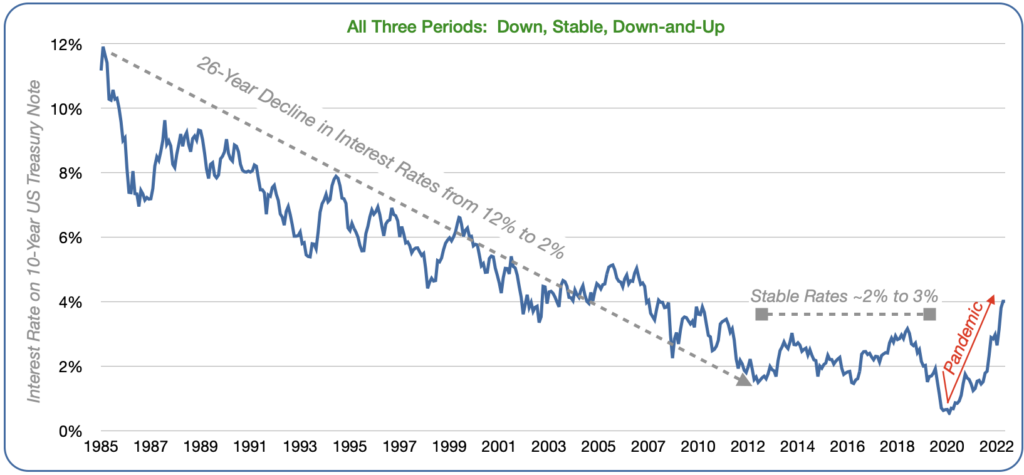

Entire Period 1985 to 2022

For over 35 years, bonds delivered good returns and acted as a diversifier and damper on stock market volatility. Regular predictions and warnings about sharply rising rates during that period never materialized. When the Fed lowered rates to boost the economy during the pandemic, the expectation was that rates would gradually rise as the economy gradually recovered. But inflation suddenly emerged and the Fed belatedly and sharply raised rates, triggering the worst bond market since the Great Depression in the 1930s. If rates stabilize now, we may return to a period of stability, possibly at higher yields (better returns) for bond investors.

Source: Federal Reserve Board of Governors, FRED Database

This information is of a general educational nature, not individual investment advice. Investing involves risk of loss. A diversified portfolio does not protect against a loss or guarantee a gain. Information in this post is believed to be accurate but may contain inadvertent errors.