Exciting Economics?

Most of us think economics is a boring subject which economists themselves label, “the dismal science.” But a 700-page book by the French economist Thomas Piketty has taken the world by storm. The book is called Capital in the 21st Century. What’s all the fuss? Most of the attention-grabbing topics of economics after WWII were about national economic growth. What policies make economies grow? That question permeates our current political discussion as well. Higher or lower taxes? Government regulation? Incentives? Social (entitlement) programs? Piketty looks at completely different questions: what causes unequal distribution of income, and what are the trends?

Rates of Growth

His basic premise is that in stable modern economies, the growth of capital (essentially, investments of various kinds) will always be greater than the growth of wages. In other words, the return from investment will always be greater than the growth of a worker’s income, says Piketty. If that’s true, the wealthy will become wealthier. Their growth rate is simply better

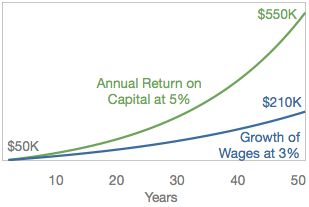

This chart  compares the hypothetical growth of wages for a worker making $50,000 growing at 3% with an investor starting with $1,000,000 earning 5%. The first year both make $50,000. Since the investor’s rate of growth is higher, over time the investor does better, assuming all money stays invested. After 50 years, the investor makes $570,000 per year while the worker is making $220,000. (Certainly the investor could have losses some years, and greater gains other years.) This basic premise about rate of growth does not consider tax policy, which can have the effect of redistributing wealth. That’s partly the reason for all the attention to this book.

compares the hypothetical growth of wages for a worker making $50,000 growing at 3% with an investor starting with $1,000,000 earning 5%. The first year both make $50,000. Since the investor’s rate of growth is higher, over time the investor does better, assuming all money stays invested. After 50 years, the investor makes $570,000 per year while the worker is making $220,000. (Certainly the investor could have losses some years, and greater gains other years.) This basic premise about rate of growth does not consider tax policy, which can have the effect of redistributing wealth. That’s partly the reason for all the attention to this book.

Is it True?

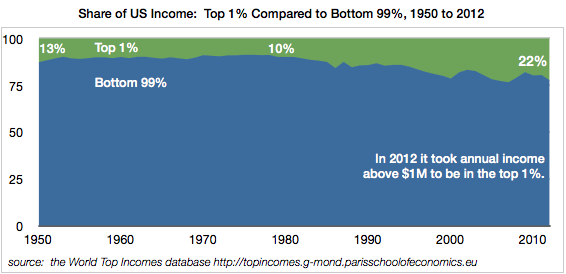

Has this theory been true in the US, based on historical data? This chart compares the income of the top 1% in the US to the bottom 99% over 62 years from 1950 to 2012. It includes income from investments and work. In 2012 you had to earn over $1M to be in the top 1%.

From 1950 to about 1980, the top 1% portion of income in the US was about the same: ranging between 13% in 1950 and 10% in 1980. The top 1% of people earned 10% of the income in the US in 1980. Then things changed. Since 1980 the top 1% has doubled in share from 10% to 22% in 2012. The dips along the way closely track US stock market declines.

Options

If a country wants to address income disparity, Piketty discusses two approaches. The first may be obvious: tax policy. A progressive tax structure, or taxes that target investment income, makes wealthier people pay more. The second is more subtle. He says countries with greater dispersion of education and skills have less income disparity; countries with concentrated education and skills have more income disparity. Unfortunately, the US has fallen out of the top ten list of countries for higher education and skills.

What about Us?

If Piketty is right, there are lots of implications. But at the individual level—you and me—it draws our attention to the benefits of saving and investing over the long run.

Notes: No investment return is guaranteed. Investments can lose money over long periods of time.