Review of 2013 Stocks and Bonds

A simple statement about stock and bond returns in 2013 is: Stocks were terrific, bonds were terrible. (See chart at bottom.)

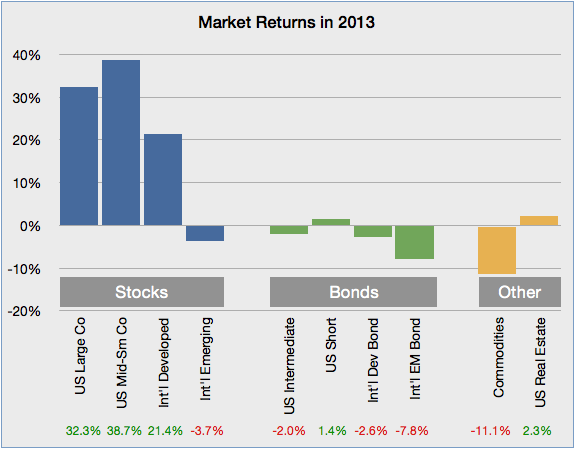

Let’s cover the bad news first. The bond markets were the worst since 1994, yet generated only small losses in the low single-digits for intermediate term bonds. Short duration bond funds eked out small gains. Long duration bond funds were hit hard — some with losses over 8%. The main reason for the poor performance was the Federal Reserve’s announced intent to reduce its bond-buying stimulus program, instituted to help the economy recover after the 2008-2009 recession. The bond market assumes interest rates will begin rising, which causes bond prices to fall. But the eventual return to more historically normal interest rates in the bond market will be good for investors. For several years, investors looking for income from bonds (often retirees) struggled with low rates.

Investors who stayed with shorter duration funds from the beginning of 2013 made the right move in bonds.

International bonds were also down.

There was also some bad news in emerging markets stocks, down about 3.7% for the year. Investors were concerned about the economic fundamentals in China and Brazil, and China’s internal credit challenges. But stock valuations based on emerging market company profitability look more attractive than US stocks now. (Will that translate into better returns?)

Commodities tumbled in 2013, down 11.1% partly because of concerns about emerging markets but also because speculative metals got hammered: gold was down 28% and silver was down 36%.

Good NewsNow the good news: US stocks had an outstanding year. Large company stocks were up over 32% (closing at a record high) and mid- and small-company stocks were up almost 39%. International developed country stocks (Europe, Japan, etc.) were up over 21%. Most notable was Japan, up 57% after nearly a decade of of poor stock returns.

The fundamentals for the US economy appear sound: slow-but-steady growth, good consumer confidence, good manufacturing forecasts, rising housing prices, federal fiscal policy that reduces the deficit (but doesn’t provide much boost), supportive monetary policy from the Federal Reserve, and low inflation: maybe the goldilocks scenario!

OverallA diversified portfolio of stocks and bonds would have performed well in 2013. The impact of rising interest rates on bonds was offset by the terrific gains in stocks.

Important: This information is educational, not specific investment advice for an individual. Investing involves risk of loss. Past performance is no guarantee of future returns. A diversified portfolio does not protect against a loss or guarantee a gain.