Make Year-End Charitable Contributions Easier

Especially at year-end you may receive requests for contributions to charities. Making the contributions before year-end can accelerate the tax benefit compared to waiting.

The only potential drawback to making lots of different contributions is keeping track of the receipts and getting them onto your tax return.

A donor-advised fund account can be a solution. It’s an easier way to manage charitable contributions and ensure that you meet the year-end deadline, even if you haven’t decided all the charities you want to contribute to. And, you get the benefit of managing your contributions with a more deliberate approach.

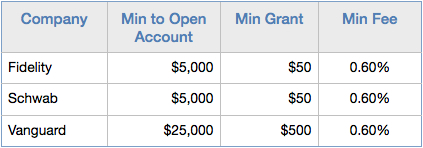

This type of account is available from companies like Fidelity, Charles Schwab, and Vanguard. When you put money into the account, it is considered a charitable contribution and you are eligible for the tax deduction right away. You then choose to disburse contributions from that account to the charities of your choice — you can do that later, even in a different tax year.

There are rules and fees that are important to understand.

The Boston Globe did a recent article criticizing accounts that accumulate contributions but don’t disburse them to charities.

But this type of account can be a way to ease the burden of record-keeping and ensure that you meet the year-end deadline.