Year-End Tax Planning: 2013-2014

It’s possible to save or defer taxes by using some tax-related workplace accounts.

Health Flexible Spending Accounts (FSA)

An FSA is a use-it-or-lose-it reimbursement account, funded with your pre-tax money. (See the end of this article for more information.)

- plan to use up the rest of your FSA balance

- submit your request for payment by your employer’s deadline

- your employer might allow a grace period for expenses in the beginning of next year

- figure the right amount for 2014: contact lenses, glasses, prescription refills, planned medical expenses with deductibles. Remember, this account is use-it-or-lose-it!

- check whether your employer adopted new IRS rules to allow FSA carryover (but without the grace period, and not for dependent care)

Retirement Savings Accounts: 401(k) and 403(b)

Save money for retirement and defer taxes to a time when most people are in a lower tax bracket.

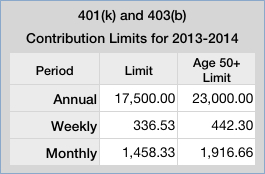

- 401(k) and 403(b) employee contribution limits did not change for 2014 (see table)

- For the age 50+ limits, your 50th birthday can be any day during the calendar year; it’s not pro-rated

- SIMPLE IRA employee contribution limit did not change for 2014: $12,000 or $14,500 for age 50+

- IRA deductible limits are unchanged for 2014: $5500 or $6500 for age 50+

- IRA non-deductible contributions are unlimited; but keep track of all your historical contributions to avoid double-taxation on withdrawal

Investments in Taxable Accounts Showing Unrealized Losses

No one likes to lose money in an investment, but at least there might be a tax benefit. Consider realizing losses for investments in taxable brokerage accounts (not 401(k), 403(b) or IRA accounts). A complete discussion of this topic requires more in-depth information, but briefly:

- selling investments for less than you paid can offset taxable gains you made on other investments or even some ordinary income

- be careful about the wash-sale rule if you want to maintain a position in that investment; you can’t sell 100 shares of GE stock to take the loss now, then buy it back the next day.

- check your year-to-date taxable gains and dividends, noting that some mutual funds distribute capital gains toward the end of the year

- you may have to track loss carry-forward if you can’t use all your losses this year

- yes, this is complicated, so contact your tax professional for advice

More about Flexible Spending Accounts

With Health or Dependent Care Flexible Spending Accounts (FSA), you can use pre-tax dollars on qualified services and purchases. That effectively means you get a discount by the amount of your marginal income tax rate plus marginal FICA rate, courtesy of the US Treasury.

Simplified Example: A person in the 25% marginal tax bracket spends $400 on qualified medical services and purchases during the year. She put $400, before taxes, into a health FSA. She saved $100 in tax — 25% of $400. She would have paid that money to the US Treasury. If she had not used an FSA she would have received that taxable $400, paid $100 of tax on it, then spent $400 on medical costs. By using her FSA, she got a $100 tax break.

But there are important rules and limits, some of which change from year-to-year. And with improper planning these accounts can backfire.

FSA vs. HSA: there is a very important difference between a Health Savings Account (HSA), and a Flexible Spending Account (FSA). The IRS has a detailed guide of each. To be eligible for an HSA, you must elect a High Deductible Health Plan from your employer, among other requirements. A health FSA is a reimbursement account with no requirement regarding choice of health plan.

Important: This information is of a general educational nature, not tax or legal advice. Contact your tax professional for advice about your situation.