What Did the Markets Do On Their Summer Vacation?

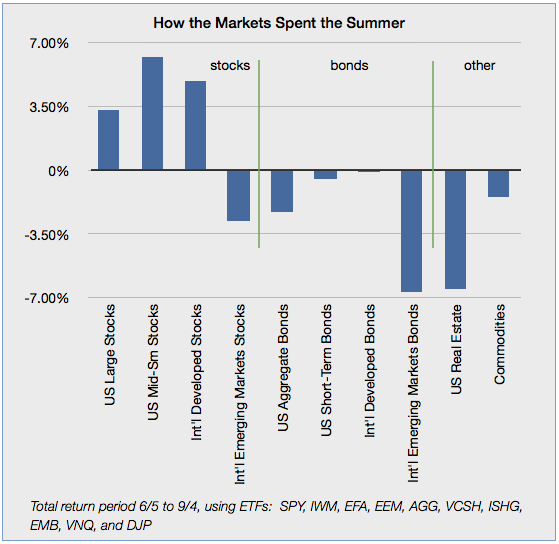

This summer US and developed international stock markets delivered nice returns, but most other asset classes declined: bonds, emerging markets stocks, real estate, and commodities.

Bonds were hurt by rising interest rates (real and anticipated). Emerging markets stocks were hurt by reports of slowing economies, fiscal challenges, currency declines, and the possibility that rising rates in the US will draw investment away from emerging markets.

We live and invest in a global interconnected set of markets.

As expected, rising interest rates hurt longer-term bond funds more than shorter-term bond funds. Although rates had widely been predicted to rise (for the past 4 years, during which rates generally fell) most analysts and investors were caught off-guard by reaction to the Fed’s announcement in June. The sell-off was swift and steep, for bonds.

The total return for iShares US Bond ETF (tracking the Barclay’s Aggregate Bond index) was down about 2.3% for the past 3 months.

That’s a steep drop for bonds, but it’s worth remembering that a steep drop for stocks is 10% or more. Stocks are historically more volatile than bonds, both up and down.

Yields on some bonds are now much more attractive than they were in the spring, and that might draw investors, firming up prices. On the other hand, further interest rate increases will send prices down more.

The sunny spot this summer was US stocks: large-company and mid- and small-company stocks were up. The S&P 500 index reached an all-time high in August. US companies have found ways to be increasingly profitable in this slow-growth economy.

This summer showed the benefit of diversification as US stocks offset some of the losses in other asset classes.

Disclosure: Investing involves risk of loss. Past performance is no guarantee of future returns. A diversified portfolio does not protect against a loss or guarantee a gain.