When Good News is Bad News

This week the US Federal Reserve issued a statement and Chairman Ben Bernanke held a press conference that triggered a broad sell-off in every capital market: US and international, stocks, bonds, real estate, and commodities. He was trying to deliver good news.

In China, short-term inter-bank lending suddenly became very expensive as the government of newly installed President Xi Jinping tries to restrict highly speculative lending by smaller banks. That intent makes sense in the long-term, but is causing market disruptions in the short-term. (An article in the Financial Times implied that the new president was deliberately making a point to the banks to reign in excesses.)

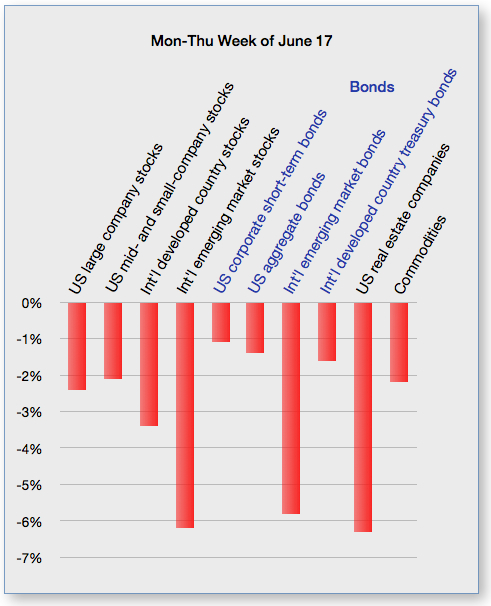

Here are the declines for this week through Thursday only:

As the saying goes, there was nowhere to hide: every asset class declined.

The good news that Chairman Bernanke was trying to talk about was the improving US economy. The improvement is good enough that the Federal Reserve anticipates a tapering off of its programs to artificially stimulate the economy.

He did not say the programs are ending now. He said they would be gradually reduced, at some point in the future. The released statement actually says the program is continuing at the rate of $85B per month—the same as past months.

In the long run, it’s best for the economy to be healthy enough that the Federal Reserve doesn’t have these stimulative programs. It should stand on its own without artificial support. The patient has improved enough to leave the hospital.

That’s what Chairman Bernanke saw as good news: we’re heading in that direction.

But capital markets move in response to speculators in the short-term, and there was selling pressure on the assumption that future market gains would only come from these artificial programs, which will eventually end.

Everyone knew these programs would end some day, and long-term analysts and economists see that as a good development. This is not new news.

But in the short-term, it’s a rough ride because of speculators.

The news from China was more mixed: an overheated real estate market in some cities has been fueled by speculative lending by smaller banks, using short-term loans. The government of the new president declined to inject cash when other lenders increased interest rates to double-digits; it wants less speculation in order to create sustainable growth rates–a good long-term goal. But in the short-term, it could have the effect of a financial crisis for China; that may explain why both emerging markets stocks and bonds were hit hard.

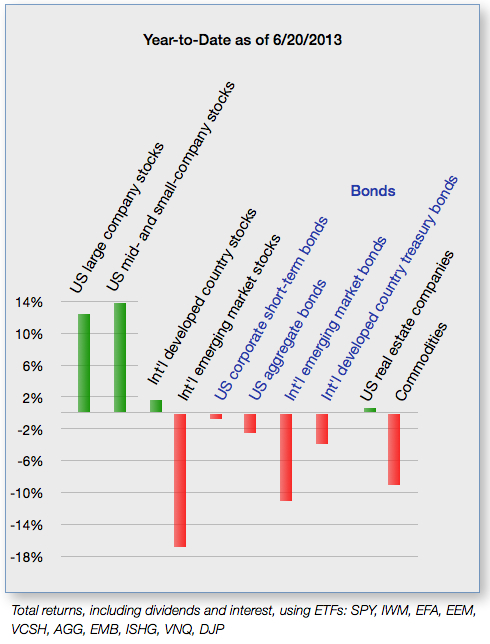

Year-to-date, US stocks are still up nicely (over 12%), while emerging market stocks and bonds are down sharply. All US bonds are down because of (anticipated) higher interest rates.

A diversified portfolio and a long-term strategy that incorporates risk tolerance have historically provided the best approach for the individual investor.

Disclosure: Investing involves risk of loss. A diversified portfolio does not guarantee a gain or protect against a loss.