PBS Frontline: The Retirement Gamble

[This post is an update to the one I wrote before the show.] The PBS Frontline program called “The Retirement Gamble” was well-done and mostly very accurate. You can see it online now. The title is a bit misleading, and came from a quote by John Bogle (below). Here are some of the points presented:

The PBS Frontline program called “The Retirement Gamble” was well-done and mostly very accurate. You can see it online now. The title is a bit misleading, and came from a quote by John Bogle (below). Here are some of the points presented:

- many Americans are not adequately prepared for retirement; Frontline asks “Who is to Blame?” More about that below.

- investment products have varying fees, and some are much more expensive than others with the same (or better) historical performance

- using lower-fee investment products can make a huge difference over a lifetime

- some workplace 401(k), 403(b), and 457(b) plans do not offer good investment options (high fees or narrow range of options)

- some advisors are not required to act in their clients’ best interest; instead their standard is “suitability”

These are all things that I talk about too.

The program tried to explain the difference between two different standards for advisors: “Suitability” and “Fiduciary or Client’s Best Interest.” It can be confusing.

My firm is a Registered Investment Advisor in Massachusetts and is required by law to act in the clients’ best interest; I look carefully at costs of investment products and generally use low-cost investment products where one is available to meet the investment strategy. The key is finding an advisor that meets these criteria, discussed on the program.

A broker is not required by law to act in the client’s best interest. The show referred to brokers as financial product salespersons. There have been recent attempts to change the broker “suitability” standard to the same as Registered Investment Advisors, but intense lobbying blocked legislation.

Retirement Gamble?In the program, John Bogle, founder of Vanguard and outspoken advocate for low-cost index funds, is quoted in a short clip saying something like, “If you want to gamble with your retirement money, go ahead!” The context was missing: he was talking about using actively managed mutual funds as a gamble, compared to low-cost index funds. While all investing involves risk of less, Bogle was referring to a variety of research indicating that actively managed mutual funds underperform index funds over long periods. Some actively managed funds do well in the short run, and that’s the “gamble” Bogle was talking about.

Who is to blame for Americans’ generally poor preparation for retirement?There are many answers to that question; some are personal, some are economic, some are public policy. The personal and economic answers are pretty clear. But here are some thoughts about public policy:

- the US has three broad policy solutions for retirement income

- employer: pensions and contributions funded by the employer

- employee: savings into retirement accounts funded by the employee

- Social Security: a contributory benefit funded 50% by employee withholding and 50% by employer

- these approaches strike a balance between individual and collective responsibility in the context of American cultural values

- declining numbers of Americans receive employer-related funding (Report of Treasury Department, 2010)

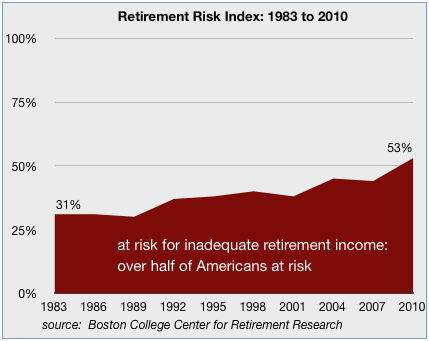

- Americans use retirement accounts but their funding varies based on the economy and is generally too low: the Center for Retirement Research at Boston College publishes a Retirement Risk Index, which climbed steadily from 31% in 1983 to 53% in 2010. That percentage is the number at-risk for inadequate retirement income.

- Social Security is projected to be underfunded in 2033, twenty years from now. Small changes now can preserve this program which is vital to so many Americans. Thirty years ago, President Reagan, Senate Leader Bob Dole, and House Speaker Tip O’Neill made changes proposed by Alan Greenspan’s commission that extended the life of Social Security (then at-risk) for decades.

The at-risk increase closely mirrors the decline in employer-provided retirement benefits. In other words, as responsibility shifted to individuals, they didn’t adequately recognize or were not able to accept that responsibility. I hope the Frontline program helps reduce that 53% at-risk.