What is the Fed’s Balance Sheet, and Should I Care?

Note: In some articles I try to explain topics that are hard for news outlets to cover because they are too complex or take place over a long period of time. This is one of those topics that you don’t hear much about yet has a huge impact on the US economy.

The US Federal Reserve (the “Fed”) has received a lot of attention lately because their actions can have a big impact on the world economy.

The Fed is part of the US government but independent of Congress and the Executive branch. Its goals are:

- keep inflation under control

- maintain full employment

- maintain the stability of the financial system

In the past 30 years, the Fed mostly focused on inflation, which is rightfully seen as a very serious threat to any country’s economy. The Fed controls short-term interest rates to try to moderate inflation.

The Great Recession

When the Great Recession struck in 2008-2009, Chairman of the Federal Reserve Ben Bernanke  took bold action that had never been done before. “Bold” is an understatement. That action continues through today.

took bold action that had never been done before. “Bold” is an understatement. That action continues through today.

The Fed owns assets, mostly US government bonds. It buys or sells bonds in the open market. When it buys bonds, it puts cash into the economy. Selling bonds takes cash out of the economy. The effect of more or less cash helps moderate the economy.

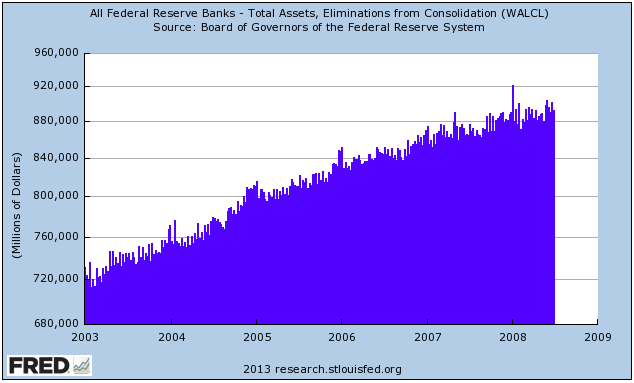

The amount of assets owned by the Fed is called its Balance Sheet. When it buys assets its balance sheet goes up and cash goes into the economy. Here’s a chart of the growth in the Fed Balance Sheet from 2003 to 2008:

This chart ends in mid-2008. The growth in the balance sheet looks steady, but it was roughly the rate of inflation, so in constant dollars it was about flat for this 5-year period. That’s the long-term history of the Fed balance sheet: very slow growth.

Then the Great Recession hit, and a financial crisis meant that the circulation of money in the economy slowed down drastically, and nearly stopped. The circulation of money is a key element in the health of an economy. The US even experienced a brief period of deflation, a spiral of declining prices that inflicted years of economic stagnation on Japan.

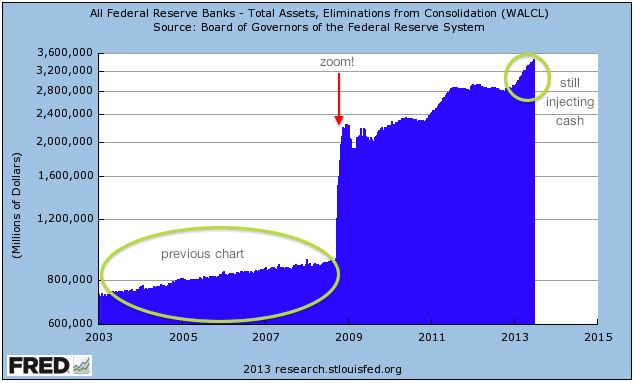

Bernanke decided to re-inflate the US economy, nearly single-handedly, by injecting massive amounts of cash through asset purchases. This chart shows the Fed Balance sheet from 2003 to June 2013:

It went from about $900B to $2200B in 9 months: growth of about 150% in less than a year. (Think about your retirement account growing that much.)

After that huge increase, the Fed has continued adding cash to the economy over the past 4 years, and today is still adding $85B per month—see the green circle in the upper right.

In normal times, this gigantic growth of cash in the economy would have caused runaway inflation and probably social unrest. Prices would have doubled or tripled. The economy would be out of control.

But for the past 4 years, we’ve seen very low inflation (most recently 1.4%) and modest growth in GDP—gross domestic product, the basic measure of the size of the economy, most recently 2.4%.

So even with historic injections of cash into the economy, growth in the US has been tepid, and unemployment remains high.

Bernanke was criticized by some in 2009 for overreach, but in retrospect most economists agree that Bernanke was right.

Now What?

There’s a quaint expression about the role of the Fed: it’s supposed to take the punch bowl away just as the party gets going.

So after 4 years of huge cash injections, is it time to take the punch bowl away? If so, how does the Fed withdraw $2T from the economy without causing another recession? (By comparison, the US economy is now $16T, so about 12% of the current economy has to be withdrawn.)

At the June 19 press conference, Bernanke said they are beginning to plan the end of this cash injection.

The bond market went down on that news because these cash injections have kept bond rates low; when bond rates rise, the value of bonds goes down.

Other markets went down because some investors feel this artificial level of cash is still needed for a good economy.

So an important economic story for the past 4 years has been the Fed’s huge cash infusions, and the story for the next period of time will be the Fed withdrawing that money through asset sales. Will it take 4 years? 10 years? 20 years? What if the Fed acts too slowly? Too quickly? No one knows.

But it will have a big impact on the US economy, global capital markets, the value of houses, and retirement accounts.

That’s why the size of the Fed’s balance sheet matters.