Are Mutual Funds Free?

When you buy a loaf of bread at the store, you know what you’re paying; you don’t know how much profit the grocery store makes, or how much the worker at the store gets, but you know what comes out of your pocket. That knowledge helps you decide which bread to buy: the $3 loaf or the $20 loaf.

When you buy a mutual fund, are you paying anything?

You are paying. But it’s hard to find out. Does it matter anyway?

Fund FeesThere are two general categories of fees you pay when you buy a mutual fund:

1) expense ratio – a percentage taken “off the top” that is kept by the fund company, and used for various purposes. This fee is taken before you receive your return from the fund.

2) load – a sales charge that pays a commission to the broker/dealer representative for selling the fund to you; there are different types of loads. If you didn’t buy through a broker/dealer rep, you don’t pay a load.

According to a recent Vanguard report, the expense ratio for actively managed stock funds averages 0.82% to 1.17%, depending on the type of stocks. To make this discussion easier, let’s say it’s 1%.

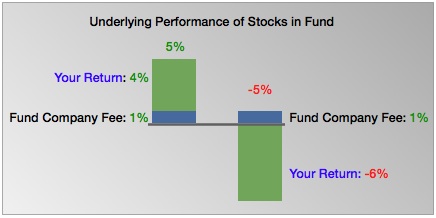

Before you receive a return from the fund, the fund company has already received its 1%. They take the fee before they report the performance of the fund. So if the underlying stocks in the fund returned 5%, you as the owner of the fund received a 4% return and the fund company got 1%. If the underlying stocks lost 5%, you see a 6% loss and the fund company still got 1% regardless.

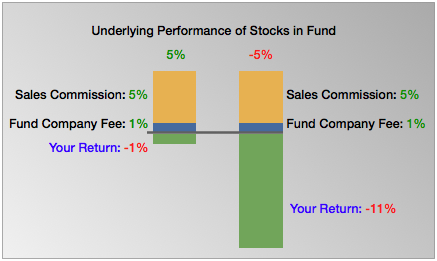

If you buy from a fund from a broker/dealer representative, you might pay a load, or sales commission, possibly as much as 5%. There are different types of sales charges that can spread out the fee. The types are: front-end load (paid in the beginning), back-end load (surrender charge), or level load (paid annually). (The share class of the fund tells the type of sales charge.) This load can have an even bigger impact on your return. The chart below assumes a 5% front-end load commission.

Taken together, the expense ratio and load can have a big impact on your return. So the key is knowing the total fee: transparency.

Impact on Your ReturnIf you buy a Lexus IS instead of a Toyota Corolla, you pay more and get more.

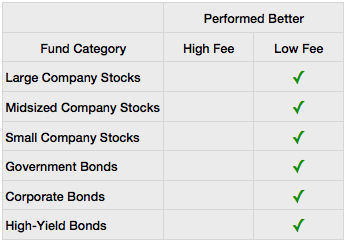

Now that you know the cost you are paying for a fund (the expense ratio plus load) are you getting something better if you pay more? Is the more expensive fund worth it, compared to a low-fee fund?

According to the Vanguard report and a Morningstar report, the answer is very simple: no. Vanguard analyzed different fund categories over 10 years, and low-fee funds performed better in every category. (Bar chart on page 10 of their report.)

Morningstar said it best, in this article (req’s free registration) about fund fees:

“If there’s anything in the whole world of mutual funds that you can take to the bank, it’s that expense ratios help you make a better decision. In every single time period and data point tested, low-cost funds beat high-cost funds.” -Morningstar

In fact, Morningstar said fees were a better indicator of future performance than its own “star” rating system!

The difference between a high-fee fund and a low-fee fund was big: high-fee funds were 5 to 8 times more expensive. That’s the difference between a $3 loaf of bread and a $15 to $24 loaf!

Mutual funds are one of the few products where paying more means getting less.

Registered Investment AdvisorsFinally, if you pay a Registered Investment Advisor (RIA) like Waypoint Financial Planning to manage your investments, you won’t pay a load, but you still pay mutual fund fees and an annual fee to the RIA, usually depending on the size of the portfolio. That fee is often about 1%. (Waypoint’s fees are less.) The fees are transparent: you know what comes out of your pocket.

If the RIA uses low-fee mutual funds, some or possibly all of that cost is recouped compared to a high-fee fund. And low-fee funds sometimes have tax advantages that an advisor can identify.

Key Points1) You pay fees: ask or find out what you’re paying — all the fees. There’s a wide range.

2) Low-fee funds outperform high-fee funds over long periods of time. It’s the opposite of “you get what you pay for.”

Disclosure: Investing involves risk of loss. Diversification does not guarantee a gain or protect against a loss.